XRP Price Prediction

XPR price prediction Based on the premise of a rate hike around May 4 and the possible favorable resolution of the aforementioned demand, a short and medium-term analysis of the XRP price can be carried out.

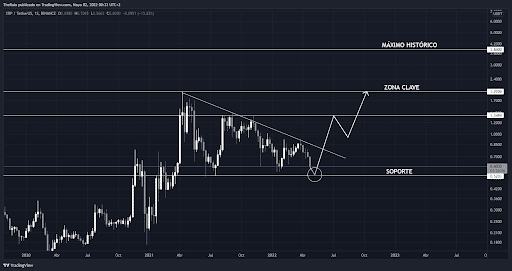

We can expect a pullback to the $0.5 zone in the coming days. This is because it is possible that before the interest rate hike the markets will fall, dragging the entire cryptocurrency market with them.

Assuming the markets recover from the news of the spike and the SEC lawsuit is resolved in the next couple of months, we could see the cryptocurrency market and more particularly XRP take off. Due to these fundamentals, we place 3 objectives at the price of Ripple for this year 2022:

- First target: $1.34. This target is the most conservative and would simply need a short alt season with Bitcoin hovering around $50,000 to achieve it. Not even a favorable resolution of the lawsuit would be necessary.

- Second target: $2. This goal is somewhat more difficult to achieve. XRP would need either a Bitcoin rally to all-time highs or good news coming from the SEC. However, it is very likely that this goal will be achieved.

- Third target: $3.84. This price corresponds to the historical maximum of XRP. For this, the market capitalization of cryptocurrencies must increase a lot and add to the good news around the demand. It is a price that XRP will undoubtedly reach in the long run. However, we believe that it is practically impossible for this objective to be achieved this year.

Should you buy XRP?

The investment risk in XRP is higher than that of other cryptocurrencies. If all goes well, it can be very beneficial but, however, having lost strength against other projects and with existing investment opportunities, it is a somewhat complicated decision.

On the other hand, if after studying the SEC case you are confidently expecting a favorable resolution for Ripple, then perhaps you can consider buying XRP which, without a doubt, is a great project diminished by US legislation.

How Are Crypto Signals Generated

The best crypto signals are generated based on both technical and fundamental analyzes. With trading indicators, you can also generate your signals, but they are really professional. Because there are tens of indicators you can use to generate these signals, the trick also lies in knowing the most relevant for your circumstance.

You would need experience. Best crypto signals are again based on a combination of auto and manual trading tactics. Best paid crypto signals for trading are based on technical charting and fundamental analyzes and rely on info collected by bots (mainly and efficiently) from social media channels.

- Chart a style

On a crypto charting platform like change. On those systems, you basically select the indicator and time frames on a given buying and promoting pair, as an instance, BTC/USD, and the chart is robotically generated.

- Decipher a fee sample

As soon as a chart is generated for a given indicator, a sample is deduced approximately from the chart as directed with the useful resource of the indicator fashion strains. Those manuals on information on the rate motion factors are the hardest to decipher in constructing crypto buy and sell indicators. It’s far here that an extraordinary deal statistics and revel in exercise. The different chart patterns to count on a chart encompass enables/resistances, huge movement, consecutive candles, pressure, butterfly, ascending/descending triangles, head, and shoulders or inverse head and shoulders, channel up/down, falling wedge, double backside/pinnacle, triple backside/pinnacle, bullish flags, rectangle, bullish pennant, Gartley, ABCD, and three-factor extension or retracement.

- Expect the charge action

The predictable fee by way of and big falls in the pattern until the sample predicts a breakout in a single or fee recommendations, i.e. At the drawback or upside. The evaluation generates an actionable trading sign which basically predicts – in layman’s language, a future viable price at which the trend is brilliantly headed as deciphered by the usage of the charting and indicator information.

- Observe the fee motion:

Most crypto signals are generated and re-fed into automobile buying and selling bots for automatic crypto or asset buying and selling. Investors also can generate and practice their indicators manually however its miles tasking and restricted due to the fact such analyses wouldn’t take in as heaps of numerous and relevant marketplace data as can be inexperienced bots that pull statistics from more than one source in seconds.

Hello, My name is Shari & I am a writer for the ‘Outlook AppIns’ blog. I’m a CSIT graduate & I’ve been working in the IT industry for 3 years.