Much like archaeologists carefully excavate artefacts to reveal hidden stories, traders delve into the layers of currency pairs, uncovering a critical element known as the spread. Imagine the spread as the archaeological find that provides clues about the past and future of the market, and the bid and ask prices as layers of sediment. In order to discover the insights that forex spreads offer and why these artefacts are so important to the world of currency trading, we will be going on an archaeological dig in this essay. To uncover the secrets of the market, a trader needs to comprehend the language of spreads, just like an archaeologist decodes ancient symbols.

What is Spread in Forex Trading?

The discrepancy between the ask and bid values of a currency pair is known as the forex spread in the trading market. The amount a buyer is ready to pay for a pair of currencies is known as the bid price, and the price at which a seller is willing to sell is known as the ask price. The spread is simply the cost of making a trade and is measured in pips, the smallest price movement in the exchange rate of a currency pair.

Components of Spread:

1. Bid Price: The bid price is the lower of the two prices in a currency pair and represents the maximum price a buyer is willing to pay.

2. Ask Price: The higher of the two prices, the ask price is the lowest amount that a seller will take.

3. Spread: The spread is the actual amount that separates the ask and bid prices. For example, if the EUR/USD currency pair has a bid price of 1.1200 and an ask price of 1.1205, the spread is 5 pips.

Types of Spreads:

There are generally two types of spreads in forex trading:

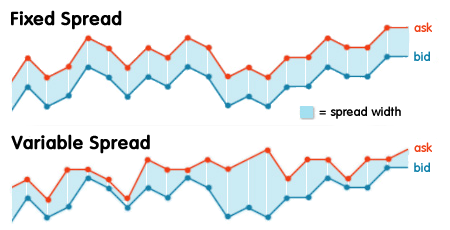

1. Fixed Spreads: Certain brokers provide fixed spreads, meaning that in a typical market, the difference between the ask and bid prices doesn’t change. More trading cost predictability may result from this for traders.

2. Variable Spreads: Variable spreads change according to the state of the market. Variable spreads may widen during periods of high volatility or limited liquidity, raising the price of placing a trade.

The Significance of Spread in Forex Trading:

Understanding the spread is very important for several reasons:

1. Trading Costs: One key part of trading costs is the spread. Greater spreads may raise a trade’s total cost, which may have an effect on possible gains or losses.

2. Liquidity: While unusual currency pairs or ones with less liquidity may have bigger spreads, major currency pairs with substantial trading volumes typically have narrower spreads. Liquidity should be considered by traders when selecting which currency pairs to trade.

3. Broker Comparison: Spreads can vary between different brokers. Traders should consider the spread, along with other factors such as execution speed, trading platforms, and regulatory compliance, when selecting a broker.

Summary

Trading forex requires a consciousness of the spread, which serves as a necessity for traders to make intelligent decisions. It may have an effect on overall trading expenses and profitability. It indicates the cost of carrying out a trade. Whether fixed or variable, understanding the spread and considering it alongside other factors is essential for successful forex trading. Traders should stay informed about market conditions and be mindful of how spreads may fluctuate, particularly during times of increased volatility.