Have you ever felt like you’re always just scraping by financially? No matter how hard you work, you never seem to get ahead. You’re not alone – many people struggle with feelings of financial stress, worry, and insecurity. The path to true financial success and independence can feel murky and out of reach. But it doesn’t have to be this way. Building wealth and achieving financial freedom is possible with the right strategies and mindset shifts. This article will share the key principles by experts like Alfred Sollami that have helped people reach their financial goals – developing multiple income streams, lowering expenses, eliminating debt, planning for retirement, investing for the long term, and automating savings. By focusing on these areas and adopting a wealth-building mindset, you can take control of your finances and secure your financial future. Let’s dive into the strategies and start your journey to financial success.

Reduce Your Expenses

It’s easy to live on autopilot, swiping cards and throwing cash at every little whim. But those little expenses add up. They add up so much that we often wonder where our money went. It’s time to take control of those little expenses and distinguish between wants and needs. Start by tracking your spending for a month. How much you spend dining out, monthly subscriptions and unnecessary purchases might surprise you.

Once you’ve seen where your money is going, it’s time to trim the fat. Instead of grabbing takeout for lunch every day, try brown-bagging it instead. Cancel subscriptions that you never use. By taking control of your expenses, you’ll find it easier to reach those financial goals you’ve set for yourself.

Pay Off Debt

Financial expert Alfred Sollami knows debt can be overwhelming and stressful. The thought of interest charges piling up and never being able to pay off your balances fully can be daunting. That’s why developing a debt repayment plan is so important. By prioritizing high-interest debt like credit cards and creating a strategy to pay them off quickly, you’ll save significant money in interest charges in the long run.

It may take some sacrifice and discipline, but debt-free is finally worth it. So, take the first step towards financial freedom and start making your debt repayment plan today.

Build An Emergency Fund

Financial shocks can come out of nowhere, be it a sudden job loss, a medical emergency, or unexpected home repairs. However, you can face these challenges head-on without stress with an emergency fund. The key is to save 3-6 months’ worth of living expenses in a high-yield savings account, which will allow you to have a cushion to fall back on when disaster strikes.

With this fund, you’ll be able to manage these emergencies easily and avoid going into debt or taking out high-interest loans. So, start saving now, and you can rest easy knowing that you’ll be able to weather any financial storm that comes your way.

Invest For The Long Run

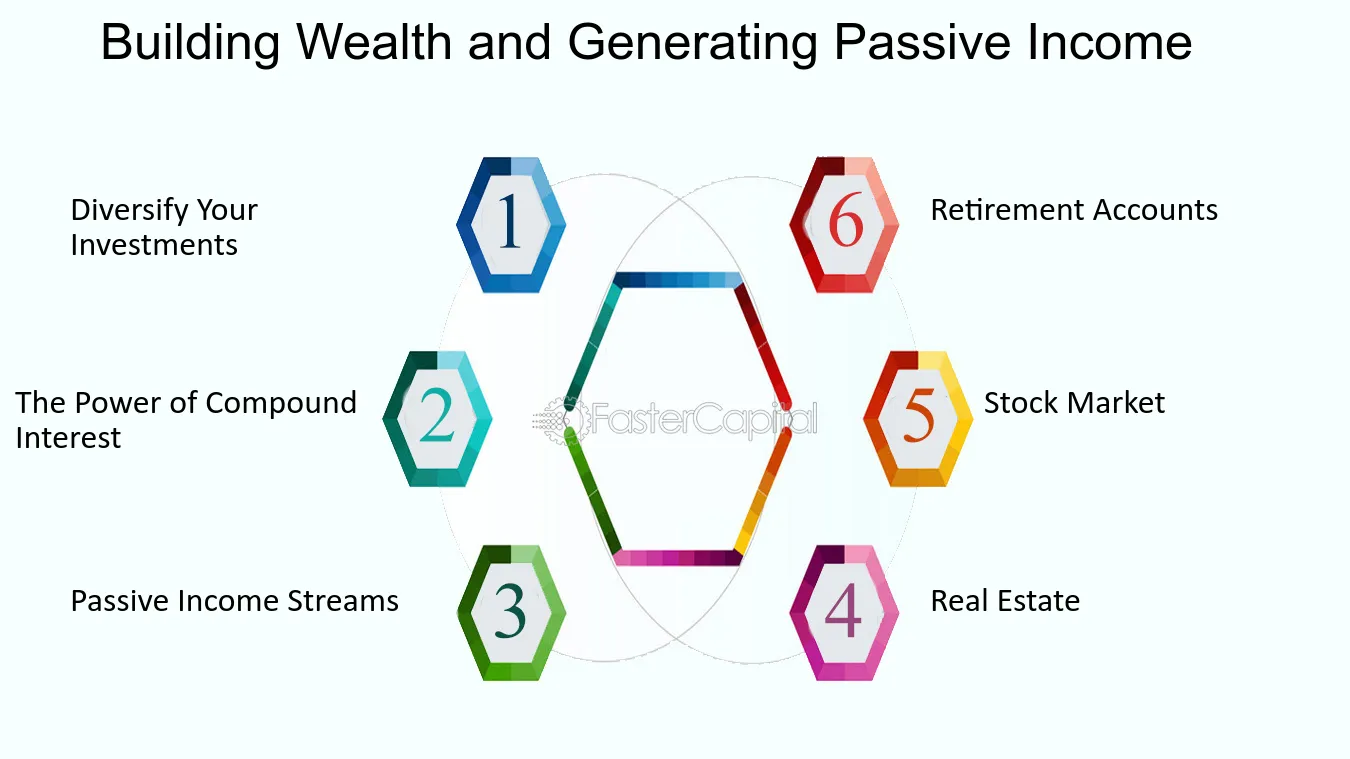

Are you already planning for your future? If you haven’t thought about it, you should start now. Investing in low-cost stock market index funds is one of the best ways to secure your financial future. And the best part? You can save on taxes using tax-advantaged retirement accounts like 401(k)s and IRAs. By investing in these accounts, you’re giving yourself the gift of compound interest.

Compound interest is when the interest earned on your investment is reinvested, allowing your investment to grow even more over time. So, don’t wait any longer – start investing for the long run and let the magic of compound interest work for decades.

Learn New Skills

Continuous self-improvement through education can be incredibly beneficial to make ends meet or broaden your skill set. Knowledge in various fields can make you more marketable to employers and increase your chances of obtaining higher-paying jobs. Additionally, with the rise of freelancing and side gigs, technical skills have become invaluable.

Staying up-to-date on the latest technology and software can give you an edge over the competition. Whether taking courses online, attending evening classes, or even reading books on your own time, investing in your education is an investment in your future.

Budget Diligently

Budgeting can seem intimidating, but it’s crucial to achieving your financial goals. Keeping track of your spending and savings can provide a clear understanding of your financial situation. Monitoring your progress can help you stay on track and make informed decisions about your money.

But be sure to take changes in your income or expenses into account. Adjusting your budget can keep you on the right track, whether a salary increase or unexpected expense. Diligently monitoring your budget can lead to a brighter financial future and set you up for success.

Automate Investments And Savings

Investing and saving money can be discouraging for many, but with the help of technology, it doesn’t have to be. That’s where financial experts like Alfred Sollami come in. Automating your savings and investments may be the solution you need. By setting up monthly automatic transfers, you can make the behavior effortless and consistent. No more forgetting or procrastinating.

You can sit back and watch your money grow without lifting a finger. Plus, you’ll have the peace of mind knowing you’re actively working towards your financial goals. So don’t wait any longer. Set up those automatic transfers and take control of your financial future today.

Conclusion

In conclusion, by putting in the effort to consciously make smarter financial decisions, you set yourself up for long-term success. Whether reducing your expenses, paying off debt, building an emergency fund, investing for the long run, learning new skills, or budgeting diligently, you can take various steps to ensure your financial well-being. It is important to automate investments and savings so these money habits become a natural part of your routine. Start making positive changes today and reap the rewards of smart budgeting. Check out our other resources to help with your financial journey.